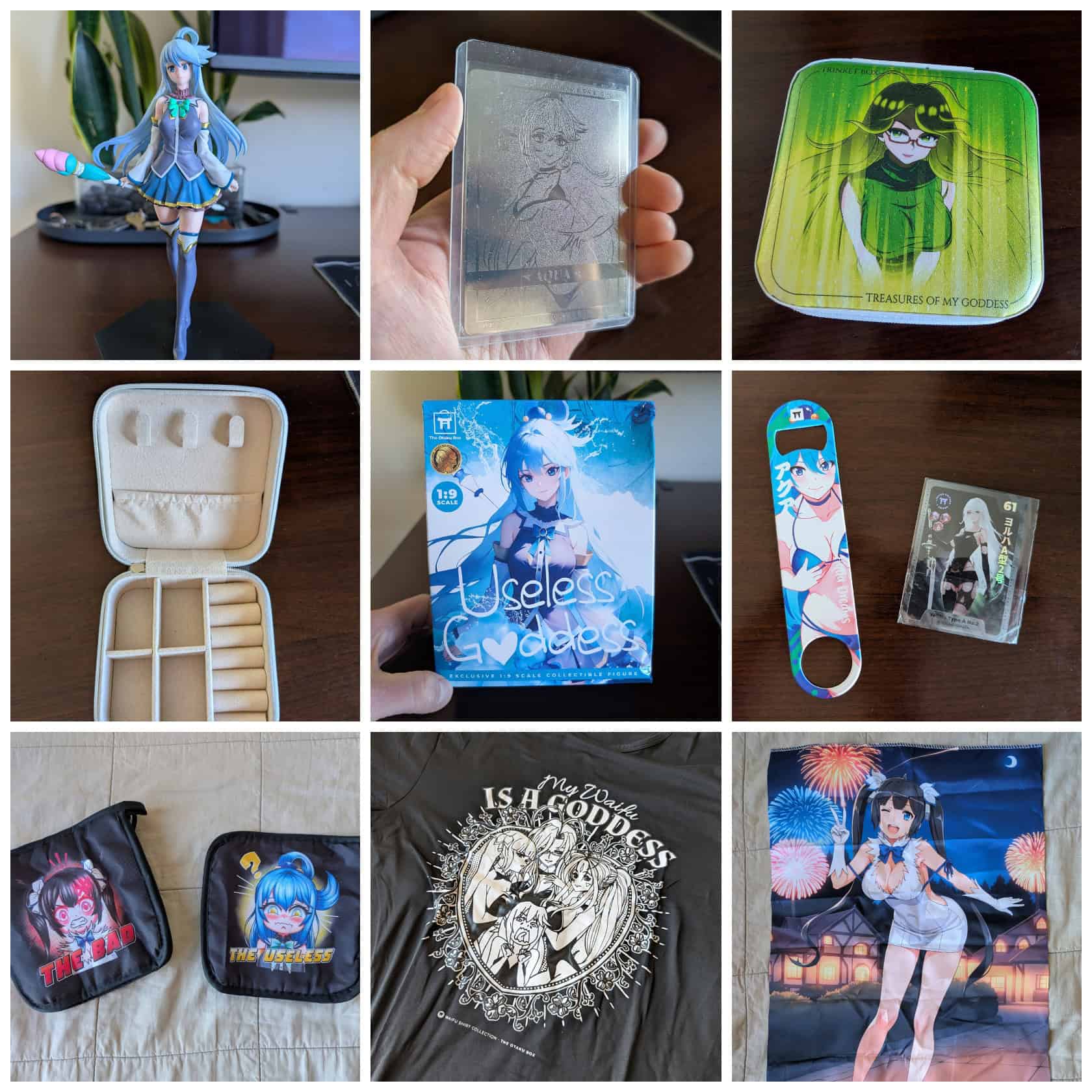

Are you uninterested in struggling to stay to your monetary targets or enhance your financial savings? A latest examine discovered 83% of individuals really feel extra motivated when duties are changed into video games—a technique often called monetary gamification.

This put up will present how including rewards, challenges, and progress monitoring might help enhance your saving habits and become profitable administration enjoyable. Learn on to learn the way enjoying video games would possibly lead you towards higher private funds.

Key Takeaways

Monetary gamification makes saving cash enjoyable through the use of rewards, challenges, badges, and progress monitoring. This helps folks keep engaged in budgeting and attain financial savings targets sooner. For instance, fintech apps like Monobank award badges for well timed funds; Mint makes use of leaderboards to let customers compete with friends.

Turning monetary duties into video games can enhance motivation and enhance monetary literacy. A 2019 survey discovered that 83% of employees felt extra motivated at their jobs when coaching included game-like options. A examine involving 2,220 college students additionally confirmed on-line finance video games raised cash abilities considerably in comparison with conventional classes.

Gamified budgeting instruments present constructive outcomes: Progress monitoring visuals can enhance aim achievement charges by as much as 27%. Frequent examples embrace month-to-month “no-spend” challenges or “round-up” apps that flip small change from card purchases into massive annual financial savings (over $700).

An excessive amount of give attention to gaming incentives has dangers: Customers would possibly chase fast wins over sound long-term selections—spending past budgets only for cashback factors or greater leaderboard ranks. Researchers proceed finding out these downsides as reliance on gamified mechanics might hurt total monetary well being.

Monetary gamification will seemingly broaden quick sooner or later—anticipated market progress is 17% every year via 2028, reaching almost $49 billion. By round 2025, AI-driven cash administration video games providing customized saving suggestions primarily based on consumer conduct will grow to be frequent alongside superior cloud expertise updates.

What’s Monetary Gamification?

Monetary gamification makes use of sport components like rewards, competitors, and progress bars to make managing cash pleasant. First named in 2002, it grew to become in style over the past ten years for higher consumer engagement in areas comparable to digital banking apps and monetary planning instruments.

Apps comparable to Monobank or Revolut apply this methodology by giving badges while you hit financial savings targets or rewards via cashback applications. It prompts your mind’s pleasure middle much like health trackers rewarding train milestones—and even the excitement achieved from enjoying on Bitcoin casinos.

This helps kind robust monetary habits round budgeting, saving, debt discount, and boosts total monetary literacy with out stress or boredom.

Key Ideas of Monetary Gamification

Video games seize our consideration via enjoyable tales, pleasant competitors, and clear targets that push us to save lots of extra. Utilizing digital banking options with playful options boosts buyer engagement and leads customers right into a rewarding move state.

Storytelling and Narrative

Storytelling could make monetary gamification enjoyable and actual. Relatable characters who face money owed, expense monitoring troubles, or saving for well being prices seize males’s consideration via empathy.

Sturdy visuals and audio components in cellular apps add depth to the consumer expertise. Compelling conflicts, like repaying a bank card debt or dealing with sudden bills, replicate points males know nicely—and spark curiosity.

A examine on buyer engagement discovered that customers keep concerned longer when tales mimic their very own cash struggles in digital banking options.

Tales make finance private—every character’s wrestle turns boring numbers into targets value chasing.

Progress Monitoring and Suggestions

![]() Progress monitoring helps males keep centered on financial savings targets. Digital instruments, comparable to budgeting apps and cellular banking platforms, use visuals like progress bars or leaderboards to ship immediate suggestions in your monetary efficiency metrics.

Progress monitoring helps males keep centered on financial savings targets. Digital instruments, comparable to budgeting apps and cellular banking platforms, use visuals like progress bars or leaderboards to ship immediate suggestions in your monetary efficiency metrics.

Research present that gamified monitoring can enhance aim achievement by as much as 27%, simply as households utilizing exercise trackers grew to become extra energetic each day. Actual-time updates from fintech corporations allow you to rapidly see the place your money flows every month and assist pinpoint spending habits that hinder buyer retention of financial savings plans.

Instant suggestions via a gamified method motivates customers to regulate behaviors quick, lowering the danger of debt settlement points or slipping into undesirable chapter conditions down the highway.

Rewards and Achievements

Rewards and achievements faucet into males’s pure need for achievement. Many budgeting apps, like QuickBooks or monetary instruments from Truist Financial institution, use badges or cashback rewards to spice up consumer engagement.

Fintech corporations have discovered that clear incentives—comparable to reductions, bonus factors, or particular presents—inspire customers to satisfy their saving targets sooner and cut back debt sooner. Males get satisfaction from hitting targets set by goal-setting options in cellular functions like Venmo or ApplePay; this sense of accomplishment builds higher habits over time.

For example, opening a secret checking account can supply extra financial savings perks value reaching milestones for—and personally talking, attaining these rewarding steps makes the entire expertise extra pleasant.

Competitors and Challenges

Competitors creates a robust push to succeed in monetary targets. Leaderboards, badges, and rankings encourage customers to save lots of extra, spend properly, and minimize debt sooner. Apps like Mint use competitors by displaying males their progress towards friends.

Day by day rewards applications add challenges that gasoline motivation via regular progress monitoring. Monetary apps even make use of behavioral nudging—leveraging primary human psychology—to spice up buyer engagement and retention in gamified saving journeys.

What will get measured will get improved. – Peter Drucker

But an excessive amount of competitors has dangers as nicely. Over-reliance on sport mechanics can lead customers into dangerous money selections or turning private finance into unhealthy rivalry. Some males would possibly chase excessive leaderboard ranks at the price of sound cash strikes or cautious aim setting with clear KPIs.

Hanging stability between wholesome challenges and sustainable habits stays key for profitable gamification in private finance instruments at the moment.

Let’s look subsequent at how these strategies impression your funds immediately: “- Advantages of Monetary Gamification on Private Finance”.

Advantages of Monetary Gamification on Private Finance

Monetary gamification will get males enthusiastic about monetary planning by turning financial savings targets into enjoyable achievements they take pleasure in chasing. With interactive budgeting apps and debt-tracking challenges, it motivates customers to take management of their cash habits daily.

Elevated Engagement in Monetary Planning

Males typically discover conventional monetary schooling boring, however gamification makes it thrilling. A 2019 survey confirmed that 83% of employees utilizing gamified coaching felt extra motivated at their jobs; this motivation can even enhance your engagement in private finance.

Progress monitoring instruments—comparable to budgeting apps with clear progress bars and financial savings challenges—maintain you concerned each step alongside the way in which. Cashback rewards, badges, referral applications, and pleasant competitors all assist enhance buyer satisfaction and loyalty by turning cash administration right into a enjoyable sport somewhat than a boring activity.

Improved Saving Habits

Gamification makes private finance really feel extra like a sport and fewer like arduous work. Budgeting apps now have artistic challenges, comparable to a no-spend month or limiting spending on meals, to assist males construct efficient saving habits.

Spherical-up apps routinely switch spare change from each day debit card transactions into financial savings accounts, turning small quantities into massive financial savings effortlessly. Different software program functions set month-to-month challenges that progressively enhance by $10 every month; beginning at simply $10 in January provides as much as a powerful $780 saved by December.

Apps utilizing storytelling, achievements, and money again incentives encourage customers to remain motivated with clear progress monitoring. These partaking strategies enhance consumer experiences via improved UI design and related suggestions from instruments like Google Analytics, serving to males monitor monetary targets clearly whereas fostering buyer loyalty over the long run.

Enhanced Monetary Literacy

Enjoying finance-based video games can tremendously strengthen monetary literacy. A latest examine with 2,220 college students from 4 international locations discovered that on-line video games improved their cash abilities by 0.313 customary deviations greater than conventional strategies did.

Budgeting apps that embrace progress monitoring bars or cashback rewards applications assist folks be taught smarter cash habits and perceive loss aversion higher than plain instruction does.

Many fintech corporations now work carefully with policymakers to spice up monetary safety for weak teams via strategic use of gamifying instruments like leaderboards, badges, and challenges.

Mastering these sport rules in private funds prepares you to sort out greater targets—comparable to chopping again debt—and that’s the subsequent key profit we’ll discover collectively.

Motivation to Scale back Debt

Motivation to scale back debt typically comes from clear progress monitoring and celebrating small wins. Debt discount apps use progress bars, graphs, and visuals, turning repayments into an thrilling problem males can take pleasure in.

These gamified interfaces present life like payoff plans in a easy method, serving to customers visualize their monetary targets clearly. Customers construct robust dedication by marking vital milestones of their reimbursement plan or incomes badges for further funds—even small ones—towards money owed like bank cards or private loans.

A aim correctly set is midway reached. – Zig Ziglar

Debt-tracking software program that exhibits remaining balances shrinking every month will increase males’s dedication to stay with monetary methods long run. Fintech corporations comparable to Truist Monetary Company supply instruments combining storytelling and competitors components via leaderboards or reward programs tied on to financial savings achieved or debt lowered.

Gamified budgeting platforms assist males keep actively centered on lowering excellent balances as an alternative of informal shopper selections that hinder return on funding efforts towards constructing wealth and safety.

Let’s try how real-life examples put enjoyable into dealing with cash.

Examples of Gamification in Private Finance

Cell finance apps use clear visuals, goal-based challenges, interactive options—the identical instruments video video games supply—to make saving cash and funds monitoring enjoyable; curious how these design concepts work in apply?

Budgeting Apps with Progress Bars

Budgeting apps like Mint sync along with your financial institution accounts to assist arrange funds clearly. They use progress bars, much like sport ranges, which present how shut you’re to assembly spending limits and saving targets.

From first-hand expertise, these instruments enhance buyer engagement by making routine cash duties really feel extra dynamic. Many fintech corporations embrace such gamification of their enterprise technique as a result of the playful visible suggestions drives motivation for higher money move administration and reduces buyer churn.

Financial savings Challenges and Objectives

Progress bars in budgeting apps are only one option to inspire higher cash habits. Financial savings challenges and clear monetary targets supply one other sensible method for males who like competitors and construction of their private finance journeys.

Well-liked methods embrace rounding up purchases via fintech firm apps, turning spare turn into financial savings with every swipe of the cardboard. One other efficient tactic is tackling a no-spend month, limiting bills strictly to primary wants—chopping out extras comparable to eating out or shopping for new devices—to rapidly enhance your saving stability.

Yr-long financial savings challenges can even maintain motivation excessive by setting particular month-to-month targets towards a bigger aim, comparable to paying off debt or investing more cash into shares or securities.

Males centered on buyer expertise perceive that clearly outlined aims assist keep momentum in monetary planning; targets give objective and path to your spending selections.

For these , small facet hustles would possibly additional improve financial savings applications; discover artistic methods to make extra cash over weekends and pace up progress towards even greater rewards.

Cashback and Rewards Packages

Cashback and rewards applications use gamification to spice up financial savings, budgeting, and accountable spending. Customary Chartered Financial institution’s 2021 Twist & Win marketing campaign is one clear instance; it shocked card customers with cashback on bank card funds, elevating buyer experiences and engagement in an enormous method.

Funds On-line studies that corporations utilizing gamification strategies see conversion charges rise by greater than 700%, proving robust success in advertising and marketing and buyer acquisition via these incentives.

Males keen on enhancing their funds can search for budgeting apps or retailers that provide reward factors for wise selections like lending much less, chopping credit score debt, or utilizing funding advisers well.

Instruments comparable to TurboTax additionally reward good monetary practices by giving reductions or particular offers when taxes are filed early. Utilizing these rewards platforms not solely will increase motivation however makes the method of saving cash sensible and pleasant too.

Leaderboards and Badges

Leaderboards stimulate competitors and clearly monitor particular person achievements, making monetary targets really feel thrilling. Apps like Revolut use leaderboards to indicate rankings amongst pals or household, even providing financial rewards for prime savers.

Badges give customers visible indicators of success, fostering loyalty and inspiring exploration in monetary apps. For instance, Monobank in Ukraine awards badges for well timed transactions and consists of mini-games that maintain customers concerned.

These methods have helped Monobank attain over 8 million energetic customers by turning private finance into playful motivation somewhat than a boring activity.

Challenges of Monetary Gamification

Whereas gamified budgeting apps might enhance your curiosity, an excessive amount of give attention to rewards can result in careless spending. Additionally, chasing badges and leaderboards would possibly distract you from good long-term saving habits.

Over-reliance on Sport Mechanics

Relying an excessive amount of on sport mechanics can lead males to chase fast wins over long-term cash targets. Factors, badges, and leaderboards really feel rewarding straight away however won’t encourage good saving habits or cautious budgeting.

In my expertise with cashback and rewards applications within the retail trade, I ended up spending extra simply to earn further factors and bonuses. Monetary scientists are nonetheless researching how gamification shapes monetary conduct; typically it could push folks into dangerous strikes or selections that would hurt their funds in a while.

Males who lean closely on apps centered solely on incentives might neglect vital facets like regulatory compliance, avoiding monetary mismanagement and lowering debt.

Danger of Monetary Mismanagement

Gamified monetary apps can lead some males into dangerous conduct, as sport mechanics might promote short-term good points over good long-term planning. Competitors and incentives like cashback rewards or badges would possibly encourage extreme risk-taking and spending past set budgets.

Overuse of progress monitoring or leaderboards in budgeting apps might push customers to chase fast wins as an alternative of secure monetary well being, inflicting debt somewhat than lowering it. Scientists proceed to check how gamification impacts males’s saving habits and total cash administration, as an unhealthy dependence on these strategies stays an actual concern for private funds.

How Will Monetary Gamification Evolve in 2025?

Monetary gamification will develop sooner than ever in 2025, pushed by synthetic intelligence (AI), cloud-based options, and huge monetary platforms. The market is about to broaden at a price of 17 % yearly and will hit $48.72 billion by 2028 because of improvements that entice extra males into private finance.

AI-powered apps can quickly give customized financial savings targets primarily based on habits or spending patterns—like your very personal MrBeast problem for budgeting or debt discount. This implies smarter gaming mechanics created via agile software program improvement lifecycles that contain UI/UX designers, programming consultants, and even collaborations with manufacturers providing incentives like cashback applications.

Cloud expertise will present cheaper updates for monetary video games, making it simple to supply recent choices with out pricey reprogramming from scratch every time. Mega monetary platforms might merge providers comparable to investing recommendation, insurance coverage protection protected via SIPC requirements, or managing loans compliant with the NMLS guidelines—all made enjoyable utilizing partaking visuals and clear progress monitoring options constructed for restricted English proficiency customers too.

Competitors could possibly be fierce between massive banks desperate to seize goal audiences on the lookout for easy but pleasant methods towards higher saving habits whereas serving to decrease cardiovascular dangers associated on to stress over unpaid money owed—a real mix of enjoyable gaming rewards combined proper alongside real-life worth propositions centered on males’s wellness wants past simply money alone!

Individuals Additionally Ask

What precisely is monetary gamification, and the way does it assist enhance financial savings?

Monetary gamification makes use of game-like applied sciences to encourage saving cash. It makes managing funds enjoyable by providing incentivized rewards while you attain your targets.

Can enjoying video games actually change spending habits for the higher?

Sure, research present that gamification can positively affect conduct—like growing altruism or serving to folks save extra constantly—by making good monetary selections pleasant.

How can monetary gamification help efforts towards non-communicable illnesses?

Gamified apps typically promote wholesome life-style selections alongside good spending habits. By rewarding customers who make more healthy selections, these instruments assist decrease dangers linked to non-communicable illnesses whereas enhancing total well-being.

Is there a distinction between “gamificaiton” and “gamificiation,” or are they simply spelling errors?

Each “gamificaiton” and “gamificiation” are frequent misspellings of the right time period: “gamification.” The right spelling refers clearly to utilizing game-based strategies in finance to inspire higher saving behaviors via partaking actions and incentives.

References

https://www.bostonfed.org/publications/communities-and-banking/2017/spring/the-gamification-effect-using-fun-to-build-financial-security.aspx

https://www.truist.com/money-mindset/rules/mind-money-connection/how-to-gamify-finances

https://www.mitrmedia.com/sources/blogs/gamification-principles-the-art-of-storytelling-and-narrative-in-elearning/

https://www.tandfonline.com/doi/full/10.1080/17530350.2021.1882537

https://www.miquido.com/weblog/gamification-in-financial-services/ (2025-01-22)

(2025-01-21)

(2024-09-18)

https://www.sciencedirect.com/science/article/pii/S0147596724000441

https://smartico.ai/blog-post/gamification-in-financial-management (2023-07-11)

https://www.smartico.ai/blog-post/gamification-in-personal-finance

https://dashdevs.com/weblog/gamification-in-financial-apps-unlocking-new-opportunities-for-growth-and-engagement/

https://www.smartico.ai/blog-post/gamification-in-financial-management

https://bigthink.com/neuropsych/gamification/

https://www.purrweb.com/weblog/gamification-in-banking-features-benefits-costs/ (2024-08-13)